It’s a challenge to be dispassionate when making decisions about your money.

Getting your Financial Plan right for you may require a better conversation and an open discussion.

“We aspire to be dynamic partners and deliver more to our Clients. We strongly believe that independence of thought, objectivity of advice and creativity of strategies means better conversations with our Clients. Our experience confirms this leads to well-designed financial plans,”

– Mike Kurz, the CEO of OverShare Advice and Planning, LLC.

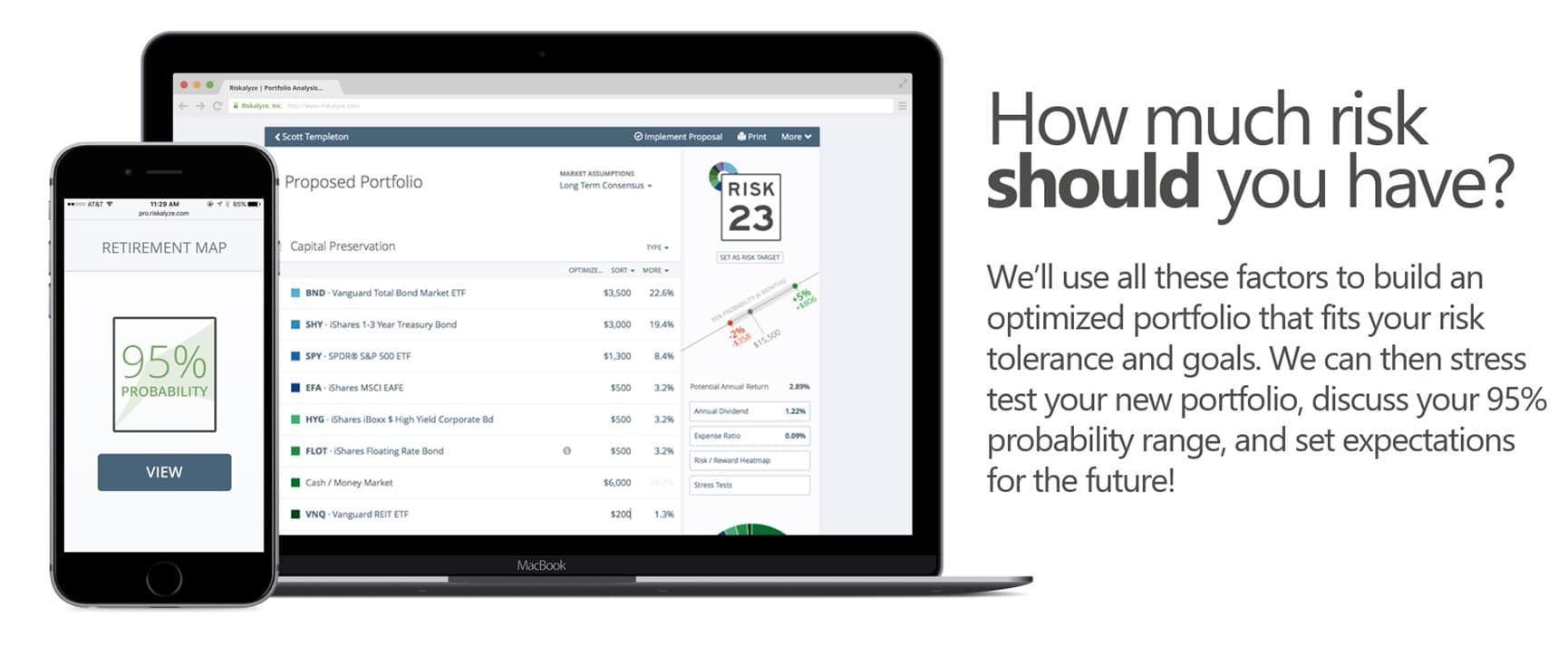

Developing a refreshing client engagement process has taken skills gained over a 20-year career. Mr. Kurz shares his firm’s view of engaging differently with Clients, “Our Clients regularly dial-in their investor risk score with a convenient online process. This helps us both understand how their view of investment risks and opportunities evolves over time. In the same way, it is necessary to understand their EQ score – their Emotional Intelligence score.”

Of the five key areas of Emotional Intelligence, the area most connected to managing your portfolio is: Self-Awareness. This is keyed into your ability to recognize your own actions and their effects. Behavioral Finance is the study of these areas that may block your success with investing in a way that is less about the financial markets and more about your frame of mind (excited or fearful). Within a family, especially a family with wealth that has survived for multiple generations, the additional areas of EQ can be vital. Look at the importance of Self-Regulation that is tied to trustworthiness and personal responsibility to enhance the positive family dynamic.

At a certain level, wealthy families across multiple generations often have formal roles for members of the family. A high EQ score in the area of empathy strengthens your ability to recognize how your family may feel about financial decisions. This is hugely important to success in your home life.

At a certain level, wealthy families across multiple generations often have formal roles for members of the family. A high EQ score in the area of empathy strengthens your ability to recognize how your family may feel about financial decisions. This is hugely important to success in your home life.

Family Dynamics are always at work in all families and in a world where talking about the impact of money challenges most families, it is helpful to seek out ideas on reducing the negative power that significant wealth can have on family emotions, relationships and behaviors. Mr. Kurz notes that confidential Client meetings should be designed to create the opportunity to share more than normal; to OverShare.

To set the stage for a client meeting, imagine a Client that is part of a family business with an estimated value of over $20 million. Although it can be volatile, and the future value is somewhat unknown, it generates a strong income for multiple generations of the family. They realize that the value of the business is difficult to cash-in on and the family hasn’t set a distinct exit for the future of the business. This poses a unique Family Dynamic.

In our first formal Financial Planning meeting with a second-generation member of the family, we narrowed in on the most important items of discussion. We quickly realized that saving money and building a nest egg outside of the company would be an emphasis of our work together. We could sense the need to have independence outside of the business without separating from the family business.

Our process and approach help us to lead our Client down a conversation path to get more clarity on what the Client truly needs to feel set – to be confident in their future. “What would it look like if you got this right,” is a question we often ask. As the client is sharing, we are taking notes and building their personal outcome statement. We are echoing back their words to help build their mental image of their preferred outcome.

The response from our Client at the end of our first call was well-guided, he said this, “I would like to grow my accounts for retirement to at least $10 million in the next ten years and be able to walk away from the business and feeling comfortable spending $250,000 a year for living expenses. The business will be separate. That’s what I need to feel good about it.”

He went on to share, “I have never told that to anyone before.”

This was a huge breakthrough! For a Client to feel so comfortable and to pass along their biggest goal and most vivid plan for the future was a sign the conversation was going seamlessly. We now have a target and we can build a path to get there. Our role is to be our Client’s partner in getting organized, staying on task, moving forward towards documented goals and remembering to celebrate victories along the way.

Do You Know Your Risk Number?

By taking your personal investor quiz, we will be able to pinpoint and quantify your specific risk tolerance, which will then help you align your current portfolio with your true investment objectives and expectations.

Contact Information

OverShareAdvice.com

(469) 777-6559

6136 Frisco Square Boulevard, Suite 400

Frisco, Texas 75034